By the end of 2024, millions of Medicare beneficiaries will face a final, painful stretch of the donut hole-a coverage gap where out-of-pocket drug costs spike after your plan pays its share. But here’s the good news: starting January 1, 2025, the donut hole disappears completely. The $2,000 annual out-of-pocket cap kicks in, and you’ll pay nothing for covered drugs after that. If you’re currently in or approaching the gap, you have less than a year to prepare. This isn’t just about saving money-it’s about staying healthy when you can’t afford to skip doses.

What the Donut Hole Actually Means in 2024

The donut hole isn’t a mystery-it’s a phase in Medicare Part D where you pay more for prescriptions after your plan and you have spent a certain amount on covered drugs. In 2024, that threshold is $5,030 in total drug costs (including what you and your plan paid). Once you hit that number, you enter the coverage gap. For the rest of the year, you pay 25% of the cost for both brand-name and generic drugs. Sounds manageable? It’s not.Here’s why: while you pay 25%, the rest isn’t free. For brand-name drugs, the manufacturer gives a 70% discount, but that discount counts toward your out-of-pocket total. For generics, your plan pays 75%, and you pay 25%. That means if you’re taking expensive biologics like Humira or Repatha, you could be paying $800-$1,200 a month out of pocket. Many people skip doses, split pills, or delay refills just to make it through.

And here’s the twist: you don’t reach catastrophic coverage until you’ve spent $8,000 in total out-of-pocket costs (including manufacturer discounts). That’s a lot. For someone on a single high-cost drug, it can take months. For someone on multiple generics, it can take over a year.

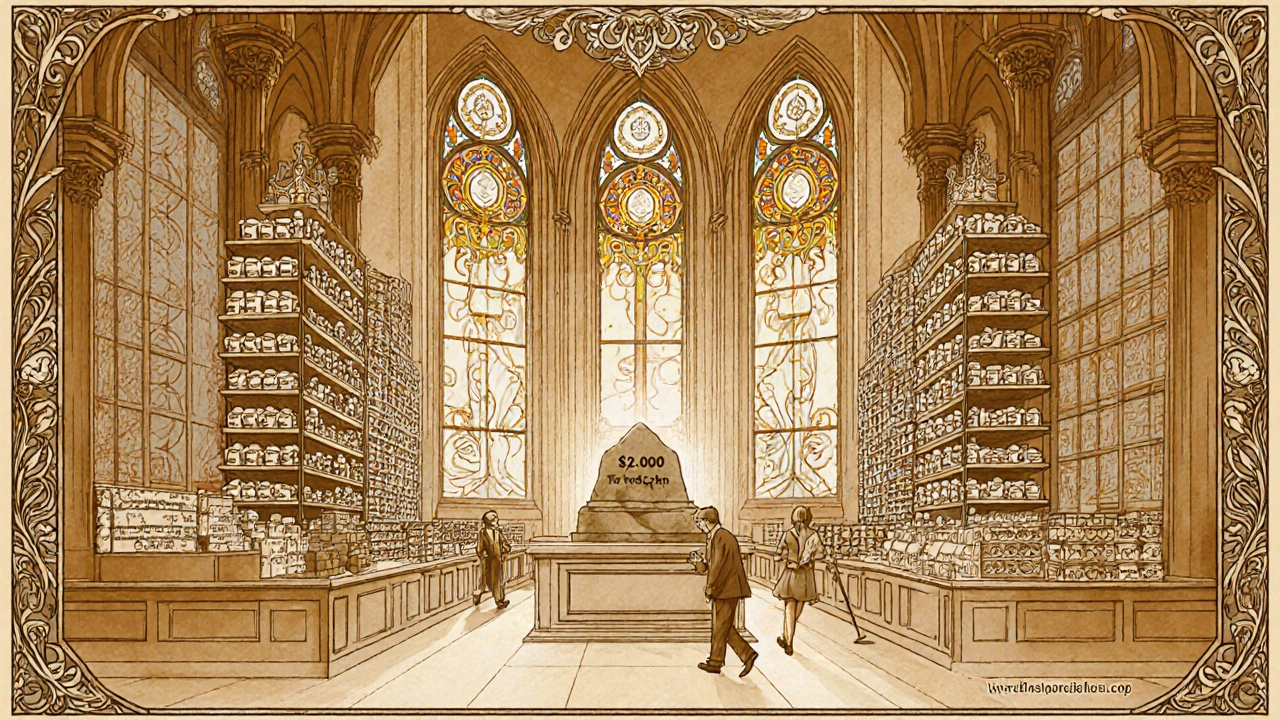

How the $2,000 Cap Changes Everything in 2025

Starting January 1, 2025, the system gets simpler-and fairer. There’s no more donut hole. Instead, there are three phases:- Deductible phase: You pay up to $590 before your plan starts helping.

- Initial coverage phase: Your plan pays most of the cost until you’ve spent $2,000 out of pocket.

- Catastrophic coverage phase: Once you hit $2,000, you pay $0 for covered drugs for the rest of the year.

That’s it. No more guessing. No more surprise bills. If your total out-of-pocket spending hits $2,000, your drugs are covered for free until December 31. This change alone could save the average beneficiary nearly $1,000 a year, according to Kaiser Family Foundation analysis.

Manufacturers will still give discounts, but they’re changing. Instead of 70% off during the donut hole, they’ll give 10% off during initial coverage and 20% off during catastrophic coverage. That’s less than before, but it doesn’t matter anymore-you won’t hit the gap. The old discount system ends December 31, 2024.

What You Should Do Right Now (Before December 31, 2024)

You still have time to act. Don’t wait until you’re in the gap. Here’s what to do:1. Check Your Plan’s Formulary

Not all drugs are treated the same. Medicare plans group drugs into tiers. Tier 1 and 2 are usually generics with low copays. Tier 3 and 4 are brand-name or specialty drugs with higher costs. If you’re on a Tier 4 drug like Humira, you’re at risk of hitting the donut hole fast.Log into your plan’s website or call customer service. Ask: “Which tier is my medication on? What’s my copay before and after the coverage gap?” If your drug is on a high tier, you might be able to switch.

2. Ask About Generic Alternatives

Generic drugs cost 80-85% less than brand names. If your doctor says it’s safe, switching from brand to generic can save you $1,200 to $2,500 a year. For example:- Brand-name Lyrica (pregabalin) costs around $450/month.

- Generic pregabalin costs $25-$50/month.

That’s a $400-$425 monthly savings. Talk to your doctor. Don’t assume your current drug is the only option.

3. Use Manufacturer Patient Assistance Programs

Big drug companies have programs to help people afford their meds. These aren’t just for the poor-they’re for anyone struggling. Companies like Amgen, AbbVie, and Pfizer offer co-pay cards, free drug programs, or discounts that can drop your monthly cost from $500 to $5.Search for “[Drug Name] patient assistance program” online. Or call the company directly. Many have 24/7 helplines. One Medicare beneficiary in Florida reduced her Repatha cost from $560 to $5 per month using Amgen’s program. She didn’t know it existed until she was in the donut hole.

4. Get a 90-Day Supply

Many plans offer mail-order pharmacies that let you get 90-day supplies at lower copays. Instead of paying $100 every 30 days, you pay $250 for 90 days. That’s a 15-25% savings per refill. It also means fewer trips to the pharmacy and fewer chances to accidentally trigger the gap early.5. Apply for Extra Help (Low-Income Subsidy)

If your income is under $22,590 (single) or $30,660 (married), you may qualify for Extra Help. This federal program covers your Part D premiums, deductibles, and eliminates the donut hole entirely. In 2023, 12.6 million people got it. You can apply online at SSA.gov or by calling 1-800-772-1213. Even if you think you don’t qualify, apply. The rules are more flexible than most people think.6. Use the Medicare Plan Finder

Go to Medicare.gov/plan-compare. Enter your drugs, pharmacy, and zip code. Compare plans side by side. Look for the plan with the lowest total cost for your specific meds-not just the lowest monthly premium. People who optimize their plan choice save an average of $1,047 a year.7. Spread Out Your Purchases (If You Can)

If you’re close to the $5,030 threshold, you might delay refills until January 2025. For example, if you’ve spent $4,900 by November, hold off on your December refill until January. That way, your 2024 spending stays below the gap. But only do this if your doctor approves. Skipping doses is dangerous. This trick works only for stable conditions, not for insulin, blood thinners, or seizure meds.What Happens After January 1, 2025?

You won’t need to worry about the donut hole anymore. Your costs will be predictable. You’ll pay your deductible, then a set copay until you hit $2,000. After that, your drugs are free. You’ll still pay your monthly premium, but your drug costs are capped.Some experts warn that premiums might rise slightly for lower-income beneficiaries because manufacturers won’t be giving those big discounts anymore. But even if your premium goes up $5-$10 a month, you’ll still come out ahead if you’re taking expensive drugs.

Real Stories from People Who’ve Been There

One man in Ohio, 72, takes three specialty drugs for rheumatoid arthritis. In 2023, he spent $1,800 a month in the donut hole. He skipped doses for three weeks and ended up in the ER. His doctor said his condition worsened because of the delay. In 2024, he switched to generics and applied for manufacturer assistance. His out-of-pocket dropped to $200/month. A woman in Texas, 68, took Humira. Her plan didn’t cover it well. She started splitting pills to make them last. Her doctor caught on during a checkup. She didn’t know she could get help. She applied for Extra Help and got her drug for free. These aren’t rare cases. In 2022, 19% of Medicare Part D enrollees hit the donut hole. Of those, 68% said they changed how they took their meds because of cost.Don’t Wait Until It’s Too Late

The donut hole is disappearing. But it’s still here in 2024-and it’s still dangerous. If you’re taking high-cost drugs, you’re one missed payment away from a health crisis. You don’t need to suffer through it. You have tools. You have options. You have time.Start today. Check your formulary. Call your drugmaker. Ask your doctor about generics. Apply for Extra Help. Use the Medicare Plan Finder. Don’t assume your plan is the best one. Don’t assume you’re stuck. Millions of people have already done this-and saved thousands.

The system is changing. Don’t let it change you.

What is the Medicare Part D donut hole in 2024?

The Medicare Part D donut hole is a coverage gap that starts after you and your plan have spent $5,030 on covered drugs in 2024. Once you enter this phase, you pay 25% of the cost for both brand-name and generic medications. For brand-name drugs, the manufacturer gives a 70% discount, which counts toward your out-of-pocket total. You stay in the gap until your total out-of-pocket spending reaches $8,000, at which point you enter catastrophic coverage.

Will the donut hole still exist in 2025?

No. Starting January 1, 2025, the Medicare Part D coverage gap (donut hole) will be eliminated. Instead, there will be a $2,000 annual out-of-pocket spending cap. Once you hit that amount, you pay $0 for covered prescription drugs for the rest of the year. This change is part of the Inflation Reduction Act of 2022.

How can I save money on my prescriptions during the donut hole?

You can save money by switching to generic drugs, using manufacturer patient assistance programs, getting 90-day supplies through mail-order pharmacies, applying for Extra Help (Low-Income Subsidy), and comparing plans using the Medicare Plan Finder. These strategies can reduce your out-of-pocket costs by hundreds or even thousands of dollars annually.

What is Extra Help, and how do I qualify?

Extra Help is a federal program that lowers your Medicare Part D costs, including premiums, deductibles, and copays-and it eliminates the donut hole entirely. In 2024, you qualify if your income is below $22,590 (single) or $30,660 (married), and your resources are under $17,220 (single) or $34,360 (married). You can apply online at SSA.gov or by calling 1-800-772-1213.

Do manufacturer discounts count toward the $2,000 cap in 2025?

No. Under the new 2025 rules, manufacturer discounts on brand-name drugs will no longer count toward your out-of-pocket spending cap. Only what you actually pay-your copays and coinsurance-will count. This simplifies the system and makes it easier to track your progress toward the $2,000 limit.

Should I change my Medicare plan before 2025?

Yes, if your current plan has high costs for your medications. Even though the donut hole is ending, plan designs still vary. Use the Medicare Plan Finder to compare how much your specific drugs will cost under different plans in 2025. You might save hundreds by switching to a plan with better coverage for your meds.

Can I still use manufacturer coupons after 2024?

Yes, but they’ll work differently. After December 31, 2024, the old Coverage Gap Discount Program ends. Manufacturers will offer new discounts-10% during initial coverage and 20% during catastrophic coverage-but these won’t count toward your $2,000 cap. You’ll still benefit from lower prices, but your out-of-pocket spending will be based only on what you pay, not on discounts.

What if I can’t afford my meds even after the $2,000 cap?

If you’re still struggling, check if you qualify for state-specific programs like Medicare Savings Programs (MSPs), which help low-income beneficiaries pay premiums and out-of-pocket costs. Thirty-seven states offer these programs. You can also contact local Area Agencies on Aging or nonprofit groups like AARP for help finding additional support.

Steve and Charlie Maidment

November 19, 2025 AT 08:35Man, I just read this whole thing and I’m exhausted. I mean, why do we have to jump through so many hoops just to get our meds? I’m 69, on fixed income, and I barely remember my own birthday, let alone how to navigate this mess. I just want to take my pills without doing a PhD in insurance jargon. And now they’re changing it again? Can’t we just have one system that works for once? I’m too tired to apply for Extra Help. I’ll just split my pills like everyone else. At least I’m still alive.

Also, who the hell writes a 5,000-word guide on this? Someone’s getting paid by the word.

PS: My cat just knocked over my insulin. That’s my life now.

Michael Petesch

November 20, 2025 AT 13:37While the structural reforms to Medicare Part D are indeed laudable, one must not overlook the broader socioeconomic implications of pharmaceutical pricing models. The elimination of the coverage gap, though beneficial, does not address the root cause: the absence of price regulation for patented biologics. The manufacturer discounts, while nominally advantageous, are essentially a form of corporate subsidy disguised as patient relief. One wonders whether the $2,000 cap will incentivize insurers to raise premiums or narrow formularies in response. Historical precedent suggests that cost-shifting is inevitable.

Richard Risemberg

November 20, 2025 AT 20:58Y’all need to hear this: you are NOT alone. I was in the donut hole last year, taking Humira, and I was about to cry every time I opened my prescription bottle. Then I found Amgen’s patient program - $5 a month. Zero. I thought I was gonna lose my house. Now I’m hiking every weekend. Your meds shouldn’t be a luxury. You deserve to live. Don’t let fear or pride stop you from calling that helpline. Seriously - pick up the phone. Someone on the other end is gonna help you. You’re not a burden. You’re a human being. And you’re worth more than a copay.

Also - generics? YES. I switched from Lyrica to pregabalin. Same effect. Half the price. My doctor didn’t even blink. You’re not betraying your health - you’re outsmarting the system. Go get your life back.

Andrew Montandon

November 22, 2025 AT 19:29Guys, I just want to say - PLEASE, PLEASE, PLEASE check your formulary! I spent three years thinking my plan was ‘good’ because the premium was low - until I hit the gap and realized my $600/month drug was on Tier 4. I switched to a plan with a $10 higher premium but covered my meds at $20 a month - saved $5,800 last year. Also - mail-order 90-day? YES. I set up auto-refill. I don’t even think about it anymore. And Extra Help? I applied thinking I made too much - got approved. The system is rigged, but it’s not impossible. You just gotta be the squeaky wheel. Don’t wait until you’re skipping doses. Do it now. Your future self will thank you - and probably send you a thank-you card with a picture of their dog.

Sam Reicks

November 24, 2025 AT 09:44So the government says the donut hole is gone but the drug companies still get to charge whatever they want? Sounds like a scam to me. I heard the $2000 cap is just a trick to make people think they’re getting help while the premiums go up and the insurers get richer. And what about those ‘manufacturer discounts’? They’re not real - they’re just bookkeeping tricks. I bet the whole thing’s a front for Big Pharma to keep their profits. They’ll just raise prices next year. You think they care about you? Nah. They care about stock prices. And the ‘Medicare Plan Finder’? That’s just a website to make you feel like you’re doing something while they laugh all the way to the bank. I’m not falling for it. I’m just going to stop taking my meds. Maybe the system will collapse faster if we all do.

Chuck Coffer

November 25, 2025 AT 17:54Wow. A whole article about how to survive the donut hole. How about we stop pretending this is a health system and call it what it is: a predatory profit machine disguised as social care? People are splitting pills because the system is broken. And now they’re giving you a shiny new $2,000 cap like it’s a gift? It’s not a gift - it’s damage control. You didn’t win. They just stopped kicking you in the face long enough to take a photo for the press release. Meanwhile, your doctor still doesn’t know how much your drug costs. Because they’re not supposed to. This isn’t reform. It’s PR.

Marjorie Antoniou

November 26, 2025 AT 07:34I’ve been helping my mom navigate this since last year. She’s 71, on two meds, and was terrified she’d have to choose between food and her blood pressure pills. We called the manufacturer, applied for Extra Help, and switched to a generic - now she pays $12 a month. She cried when she got the letter saying her copay dropped. I just wish more people knew this was possible. You don’t need to be a genius. You just need to ask. Call the pharmacy. Call the drug company. Call Medicare. Say ‘I need help.’ You’re not bothering anyone. We’re all in this together. And you deserve to be healthy. No matter what your income is.

Andrew Baggley

November 26, 2025 AT 09:50Let me tell you - this change is HUGE. I used to dread my prescription refill day. Now? I don’t even check my bank account. I just take my pills. I’ve got RA, and I was paying $900 a month for my biologic. I applied for the patient program, switched to a better plan, and now I pay $0 after $2,000. I’m not just surviving - I’m living. I’m gardening. I’m playing with my grandkids. I didn’t think I’d ever feel normal again. Don’t give up. You’ve got time. Do the steps. Call. Apply. Switch. It’s not magic - it’s just action. And you? You’re stronger than you think.

Frank Dahlmeyer

November 27, 2025 AT 22:24As a Brit who’s watched the U.S. healthcare system from afar, I’m both horrified and impressed. Horrified because no one should have to navigate this labyrinth just to stay alive. Impressed because, despite the chaos, people are fighting back - with spreadsheets, helplines, and sheer stubbornness. The $2,000 cap? It’s not perfect, but it’s a start. In the NHS, we don’t have donut holes - we have ‘free at the point of delivery.’ But even here, drugs are rationed. The difference? In America, you’re expected to be your own advocate. That’s brutal. But you’re doing it. And that’s why I’m rooting for you. Keep pushing. Keep calling. Keep applying. The system hates it when you show up.

Codie Wagers

November 28, 2025 AT 18:32One must consider the ontological implications of pharmaceutical cost structures: if a drug’s price is determined not by its utility, but by its patent status, then the market is not merely inefficient - it is metaphysically incoherent. The $2,000 cap, while ostensibly a moral concession, merely reifies the commodification of health under late-stage capitalism. The manufacturer discounts were never altruistic - they were tax-deductible PR. The new system, by excluding those discounts from the cap, further obscures the true cost of care. One is left to question: if health is a right, why must one perform administrative labor to claim it? The answer, of course, is that the state has outsourced moral responsibility to the individual. And thus, the patient becomes the janitor of their own dignity.

Paige Lund

November 29, 2025 AT 00:49Wow. So now I’m supposed to be excited that I won’t be broke by June? Cool. Guess I’ll just keep doing nothing until then. Maybe my cat will die and I’ll get disability. That’d be easier.

Reema Al-Zaheri

November 29, 2025 AT 20:59Thank you for this comprehensive and meticulously detailed guide. I am an immigrant from India, now living in the U.S., and I have been managing Type 2 diabetes with insulin and metformin. The complexity of the Medicare system was overwhelming until I read this. I have contacted my pharmacy, applied for Extra Help, and switched to a 90-day mail-order supply. My monthly out-of-pocket cost has decreased from $320 to $85. I am deeply grateful for the clarity provided. I urge all beneficiaries - regardless of background - to take action. Your health is not negotiable. Please, do not delay. The tools are available. You only need to reach out.

Michael Salmon

November 29, 2025 AT 21:51This whole article is a lie. The donut hole never existed - it was invented by the government to make people think they were being helped. The real problem is that Medicare is a Ponzi scheme. The $2,000 cap? It’s just a temporary bandage. Next year, they’ll raise the deductible to $1,500 and call it ‘reform.’ And the manufacturers? They’re already raising prices. I’ve seen the spreadsheets. The ‘patient assistance programs’ are just PR stunts. The real cost is hidden in premiums. And don’t get me started on the Medicare Plan Finder - it’s rigged to favor big insurers. You think you’re saving money? You’re being played. The only solution? Don’t enroll. Don’t pay. Let the system collapse. Maybe then they’ll fix it.