When you take a pill for high blood pressure, an antibiotic, or a diabetes medication, there’s a good chance it came from Asia. Not just any part of Asia-specifically from factories in India and China, with newer players like Vietnam and Cambodia stepping into the mix. These countries don’t make brand-name drugs. They make the cheap, life-saving copies known as generic drugs. And they supply the world.

India: The Pharmacy of the World

India’s rise in generics wasn’t luck. It was policy. In the 1970s, the government changed its patent laws to allow companies to copy drug formulas as long as they used a different manufacturing process. That opened the floodgates. Today, India produces over 60% of the world’s vaccines and 40% of the generic drugs used in the U.S. That’s not a small number-it’s the backbone of global access to medicine. The country’s pharmaceutical market hit $61.36 billion in 2024, with 75% of that coming from conventional generics. Most of the production happens in Gujarat and Maharashtra, where over 3,000 manufacturing plants are FDA-approved. But here’s the catch: only 15% of those plants can handle advanced biologics-the next generation of drugs that treat cancer, autoimmune diseases, and rare conditions. India’s strength is volume and speed. If you need a custom formulation of a generic drug, Indian manufacturers often deliver in 14 days. They also have 24/7 customer service, which U.S. pharmacy chains say has cut their operational headaches by 60%. Customer ratings on Trustpilot average 4.1 out of 5, higher than Chinese suppliers. But India has a big weakness: it depends on China for raw ingredients. About 68% of India’s Active Pharmaceutical Ingredients (APIs)-the actual medicine inside the pill-come from China. That’s a problem. If China cuts supply, India’s production slows down. That’s why India launched Pharma 2047, a $13.4 billion plan to build 12 new API parks and cut that dependency to 30% by 2030.China: The Hidden Powerhouse

China’s market is bigger-$80.4 billion in 2024-and it’s growing faster in value, not just volume. While India sells millions of cheap pills, China is selling higher-priced ones. It controls 70% of the global API market. That means nearly every generic drug made in India, the U.S., or Europe relies on a Chinese-made ingredient. China’s manufacturing is more centralized. Factories in Jiangsu, Zhejiang, and Shanghai follow strict national rules. That’s why approval times for FDA inspections dropped from 24 months in 2018 to just 9 months in 2024. But quality control is still a concern. In 2024, the U.S. FDA issued 142 warning letters to Chinese manufacturers-almost double the 87 issued to Indian firms. China isn’t just making cheap copies anymore. It’s moving up the chain. Biologics and biosimilars now make up 10% of its pharmaceutical output, up from just 3% five years ago. The government is pouring $22.8 billion into its Healthy China 2030 plan, aiming to make 25% of its exports high-value biologics by 2030. That’s a huge shift-from being the world’s chemical supplier to becoming a global innovator. Chinese suppliers are cheaper. One German healthcare company said they saved 20% on API costs using Chinese vendors. But they also had to spend more on testing and dual-sourcing after the FDA warnings. That’s the trade-off: lower price, higher risk.Emerging Economies: The New Players

While India and China fight over volume and value, smaller countries are carving out niches. Vietnam’s pharmaceutical market grew 12.3% annually from 2020 to 2024. Why? Antibiotics. Vietnam now exports $2.8 billion in antibiotic intermediates-key building blocks for drugs like amoxicillin. It’s not making finished pills, but it’s making the parts that make them possible. Cambodia is doing something different. It’s not making drugs. It’s assembling medical devices-glucometers, IV drips, syringes. Its medical device sector hit $1.2 billion in 2024, growing at 18% a year. Thanks to ASEAN trade deals, these products get preferential access to markets in Europe and Australia. These countries aren’t replacing India or China. They’re filling gaps. When global supply chains get disrupted, buyers turn to them for reliability. And they’re cheaper than Europe or the U.S. That’s their edge.

Who Wins? Volume vs. Value

India leads in volume. It’s the world’s biggest exporter of generic pills by quantity. But it ranks only 14th in market value. That’s because its drugs are cheap. China ranks second in volume and second in value. It sells fewer pills, but each one costs more. The numbers tell the story: India exported $24.2 billion in pharmaceuticals in 2024, 87% of which were generics. China exported $48.7 billion, but only 63% were generics. The rest? Biologics, traditional Chinese medicine, and innovative drugs. India’s growth forecast is higher-8.1% to 11.32% CAGR through 2030. But China’s growth is on a much larger base. So while India might grow faster, China will add more dollars to its market each year. The real question isn’t who’s bigger. It’s who’s more resilient. India’s advantage is its young population-65% under 35-and growing digital health investments. China’s advantage is its government’s ability to fund R&D at scale. In 2024, China spent $150 billion on pharmaceutical innovation, 40% of it on biologics. India spent a fraction of that.What Buyers Really Experience

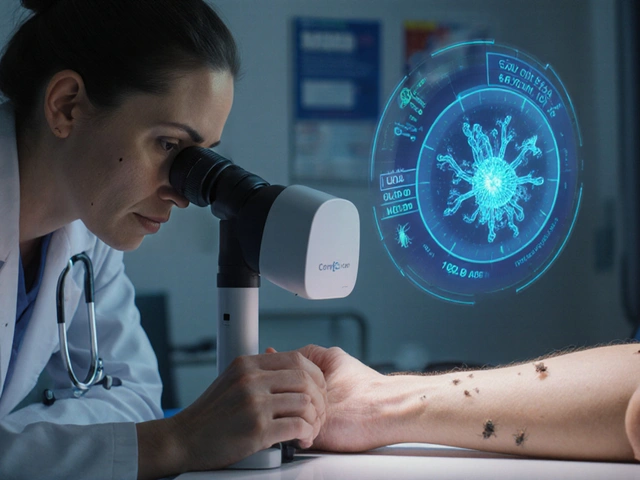

Procurement managers don’t care about GDP numbers. They care about lead times, quality, and communication. A U.S. pharmacy chain executive said Indian suppliers respond to questions faster and fix issues quicker. A German company said Chinese suppliers are cheaper, but they had to double their testing because of inconsistent quality. One common complaint about India? Regulatory chaos. There are 17 different agencies at state and federal levels. One factory in Gujarat might get approved in three months. Another in West Bengal might wait a year. China has only eight national agencies-and they’re more consistent. Logistics are another issue. India’s roads and ports add 12-15% to shipping costs. China’s integrated rail and port systems make delivery faster and cheaper. But Indian manufacturers adapt. They’ll change a pill’s color, size, or coating on short notice. Chinese factories? They stick to the plan. That’s fine for bulk orders. Not so much for urgent custom requests.

Andrew Short

January 16, 2026 AT 13:26This article is laughably naive. India and China are running a global drug cartel disguised as 'affordable healthcare'. You think those 4.1-star Trustpilot ratings are real? They're paid for. The FDA warning letters? Just the tip of the iceberg. We're literally outsourcing our medicine to countries with zero accountability. And now we're supposed to be grateful? Pathetic.

Naomi Keyes

January 16, 2026 AT 18:36While I appreciate the data presented, I must emphasize that the structural vulnerabilities in the global pharmaceutical supply chain are not merely logistical-they are existential. The over-reliance on foreign-sourced APIs, particularly from jurisdictions with inconsistent regulatory enforcement, constitutes a public health emergency waiting to happen. The FDA’s 142 warning letters to Chinese manufacturers are not statistics-they are red flags. And yet, we continue to prioritize cost-efficiency over safety. This is not fiscal responsibility; it is negligence dressed in economic jargon.

Dayanara Villafuerte

January 17, 2026 AT 20:50India: pharmacy of the world 🌏💊

China: the quiet king of chemicals 🐉🧪

Vietnam: making the building blocks you never knew you needed 🏗️

Cambodia: assembling your glucometers like a boss 🩸📈

And we’re still surprised when our pills cost $5? Nah. We’re just lazy. We let corporations decide what’s safe. 🤷♀️ #GlobalPharmaDrama

Andrew Qu

January 19, 2026 AT 08:28It’s easy to panic about supply chains, but let’s not forget why this system exists in the first place: people need medicine, and most can’t afford brand-name drugs. India and China didn’t exploit a loophole-they built a lifeline. Yes, there are risks. Yes, quality varies. But the alternative-paying $150 for a blood pressure pill-isn’t sustainable. The real win here isn’t who makes the most, it’s who keeps millions alive. Let’s push for better regulation, not just fear.

kenneth pillet

January 19, 2026 AT 09:47Jodi Harding

January 21, 2026 AT 00:54They’re not just making pills. They’re making survival possible. And we’re treating it like a supply chain problem, not a moral one.

Danny Gray

January 21, 2026 AT 04:59Wait-so the real story isn’t about generics at all. It’s about how the West outsourced its healthcare ethics to Asia and now acts shocked when the system works? We wanted cheap. We got it. Now we’re mad because it’s too efficient? The irony is thicker than Chinese API sludge.

Tyler Myers

January 22, 2026 AT 22:12Big Pharma + Chinese state control + Indian patent loopholes = you think you’re getting medicine, but you’re getting a lab experiment with a prescription label. The WHO inspection failures? That’s not a glitch. That’s the design. They’re testing *you*. And you’re paying for it. Wake up. This isn’t capitalism-it’s chemical warfare with a smiley face.

Stacey Marsengill

January 23, 2026 AT 08:18So we let a bunch of factories in Gujarat and Shanghai hold our lives hostage because we’re too lazy to make our own? And now we’re impressed they’re ‘growing’? Growth isn’t progress if it’s built on broken systems and exploited workers. I don’t want a cheaper pill-I want a system that doesn’t make me feel like a lab rat.

Jake Moore

January 24, 2026 AT 04:53Look, the system’s messy, but it’s saving lives. India’s 14-day turnaround? That’s a miracle when you’re waiting for insulin. China’s API dominance? It’s scary, but it’s also why your asthma inhaler costs $20, not $200. The answer isn’t to shut it down-it’s to demand transparency, invest in dual sourcing, and support Pharma 2047 and Healthy China 2030. We need more accountability, not less. And yeah-Vietnam and Cambodia? They’re the quiet heroes. Give them a shoutout.